How the 2025 AI Investment Boom Impacts Your Financial Plan

Why Law Firm Owners and High-Income Professionals Should Pay Attention

Are we entering another tech-driven investment supercycle? The numbers suggest yes—and if you’re a law firm owner, business leader, or high-income professional, this could directly impact your financial future.

At The Lawyer Millionaire, we specialize in helping attorneys and professionals create long-term financial freedom through personalized planning. Here’s what you need to know about today’s AI revolution—and how to strategically position your wealth to benefit from it.

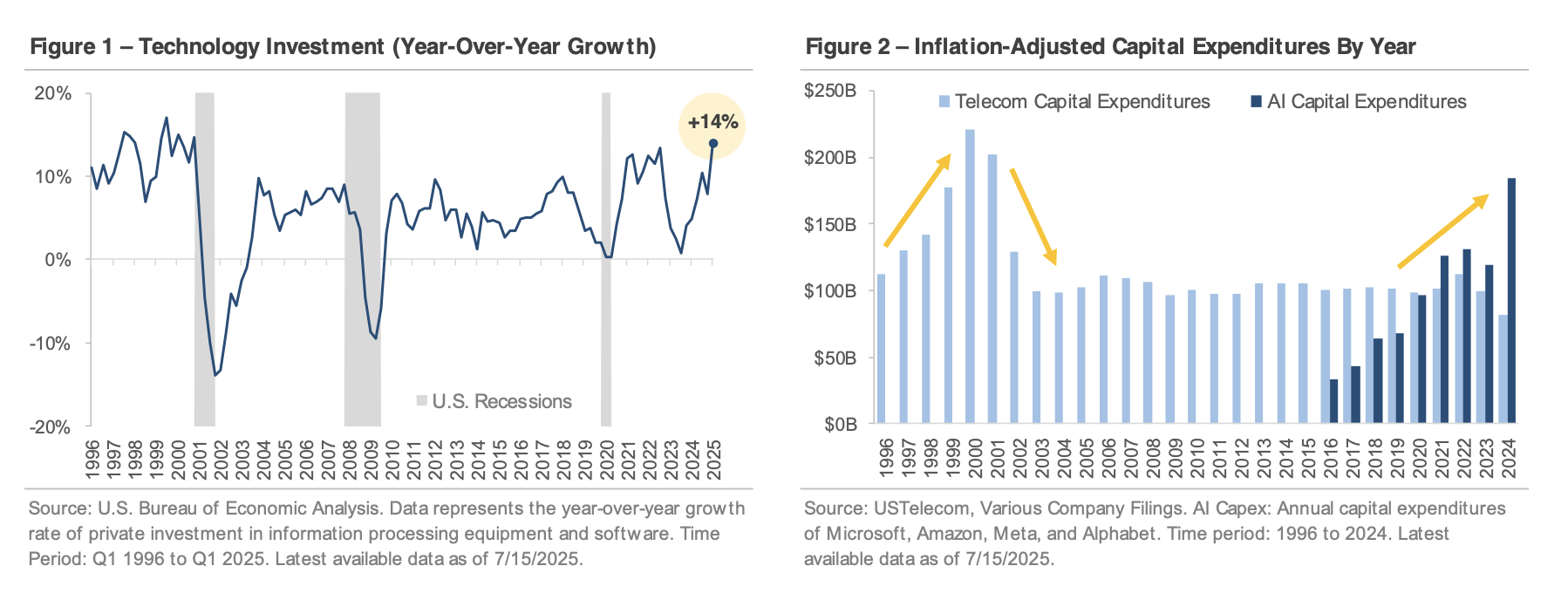

Figure 1 - Technology Investment (Year-over-Year Growth), Figure 2 - Inflation-Adjusted Capital Expenditures Per Year on Telecom and AI

AI Is Driving a New Wave of Tech Investment

In Q1 2025, investment in information processing equipment and software grew a stunning 14% year-over-year—the fastest rate since the late 1990s. That era was defined by the dot-com boom, and we’re seeing similar signs now as artificial intelligence (AI) reshapes how companies operate and invest.

Back then, telecom companies laid the groundwork for the internet age. Today, leading tech firms are investing billions into AI chips, data centers, and the energy infrastructure required to power the next generation of smart technologies.

Capital Spending on AI Could Surpass 1990s Telecom Levels

New data reveals that AI capital expenditures are approaching the historical peak of telecom infrastructure investments during the internet boom. We’re talking massive investments from companies like Nvidia, Amazon, Microsoft, and Meta—the so-called “Magnificent 7”—driving not only technological innovation but also stock market performance.

How This Impacts Your Investment Portfolio

Over the past 24 months:

The S&P 500 Technology Sector rose 66%

The S&P 500 Index gained 42%

The Magnificent 7 returned 89%

These aren’t just headlines. If your portfolio isn’t properly positioned, you may be missing opportunities—or unknowingly exposing yourself to downside risk when the growth inevitably cools off.

2 Financial Planning Lessons from the AI Boom

1. Exponential Growth Normalizes—Be Ready

Just as the dot-com bubble popped in the early 2000s, today’s AI surge will eventually stabilize. If you’re overweight in tech or chasing returns without a plan, you may be vulnerable. A balanced, customized financial strategy helps you grow steadily without overexposure.

2. Innovation = Long-Term Opportunity

The U.S. economy thrives on innovation—and strategic investing lets you participate in that growth. But participation without a plan is gambling. As fiduciary financial planners, we help our clients harness market cycles like this to build wealth over time—without relying on hype or speculation.

What Should Law Firm Owners Do Now?

Whether you’re:

Scaling your law practice

Preparing for retirement

Investing with a focus on passive income

Transitioning to passive ownership of your firm

…you need a financial advisor who understands both your profession and the evolving market landscape.

At The Lawyer Millionaire, we provide flat-fee financial planning for law firm owners—no commissions, no hidden fees, just real strategy. We integrate market intelligence like this into your broader wealth and exit planning strategy.

Want to Build Wealth from the AI Revolution—Without the Hype?

We’ll help you:

✅ Align your investments with your long-term goals

✅ Diversify your portfolio for protection and growth

✅ Build tax-smart wealth strategies tailored to your firm

✅ Design a business exit plan that supports your dream lifestyle

📅 Schedule your free strategy session today

Disclosures

The content presented is for informational and educational purposes only. It does not constitute personalized financial advice. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal. Indexes are unmanaged and cannot be directly invested in.