Business & Financial Planning Blog Articles for Law Firm Owners

Running a solo firm doesn’t have to mean running yourself into the ground. The Solo Attorney Practice Blueprint is your one-page business plan built specifically for solo lawyers who want clarity, focus, and profitability. Learn how to define your vision, attract ideal clients, and set measurable goals without the overwhelm of a traditional business plan.

From tulips to tech stocks, history’s biggest market bubbles reveal timeless lessons about emotion, greed, and the illusion that “this time is different.” In this article inspired by A Random Walk Down Wall Street, The Lawyer Millionaire breaks down the world’s greatest financial manias—and what law firm owners can learn to protect and grow their wealth with a smarter, steadier investment strategy.

Are we in an AI bubble? From the 1600s Tulip Mania to today’s tech-driven markets, history shows that every generation faces the same temptation — to chase trends instead of fundamentals. In this deep dive, Darren Wurz, CFP® and Founder of The Lawyer Millionaire, unpacks the lessons law firm owners can learn from past bubbles to build smarter, steadier investment strategies. Drawing insights from Burton Malkiel’s A Random Walk Down Wall Street, Darren reveals how to avoid FOMO, stay grounded in what works, and build real wealth that leads to freedom.

The rise of distributed law firms like FisherBroyles, Scale LLP, Rimon Law, and Pier Ferd is transforming how lawyers build their careers — and their wealth. These firms offer unprecedented freedom, flexibility, and income potential, but they also shift the financial burden squarely onto the attorney. Without the structure of a traditional partnership, you become your own business — responsible for your taxes, benefits, retirement, and long-term financial security.

One of my very first law firm owner clients was making a high six-figure income but felt constantly behind — no savings, unpredictable cash flow, and zero clarity on retirement. Together, we built a plan that smoothed out his income, reduced his tax burden, and set him on track for retirement. His outlook went from 0% to 75%, and for the first time, he felt confident about the future.

SEO for law firms isn’t just about getting clicks—it’s about building a reliable engine for growth. As financial planners for law firm owners, we see too many firms leave money on the table by neglecting search engine optimization. In this guide, we break down how law firm SEO, from local strategies to SEO for personal injury lawyers, can fuel predictable revenue, strengthen your cash flow, and increase the long-term value of your practice.

Direct indexing lets you own the individual stocks of an index—giving you the power to customize your portfolio, harvest tax losses, and invest in line with your values. For high-income law firm owners, it can mean keeping more of what you earn while maintaining market-level diversification. Learn how it works, the benefits and drawbacks, and whether it’s the right fit for your wealth strategy.

Whole life insurance is often marketed as a safe, tax-efficient retirement strategy—but few law firm owners are warned about the risks of policy implosion and the resulting surprise tax bill. In this eye-opening article, we break down how borrowing from your policy can quietly erode its value, trigger a massive tax liability, and leave your beneficiaries with nothing. As fiduciaries who don’t sell insurance and operate on a flat-fee basis, we give you the unbiased truth about what’s really going on inside your policy—and how to protect yourself before it’s too late.

You've probably heard the pitch: whole life insurance offers “tax-free retirement income,” “guaranteed growth,” and “your own private bank.” But is it actually the best move for your law firm’s financial strategy?

Want to boost your law firm’s profitability without working longer hours? This article breaks down the key performance metrics every successful law firm should track—like realization rate, utilization, and revenue per lawyer—and shows how small changes in the right numbers can drive major financial results. Stop guessing and start growing with a data-driven strategy tailored for law firm owners.

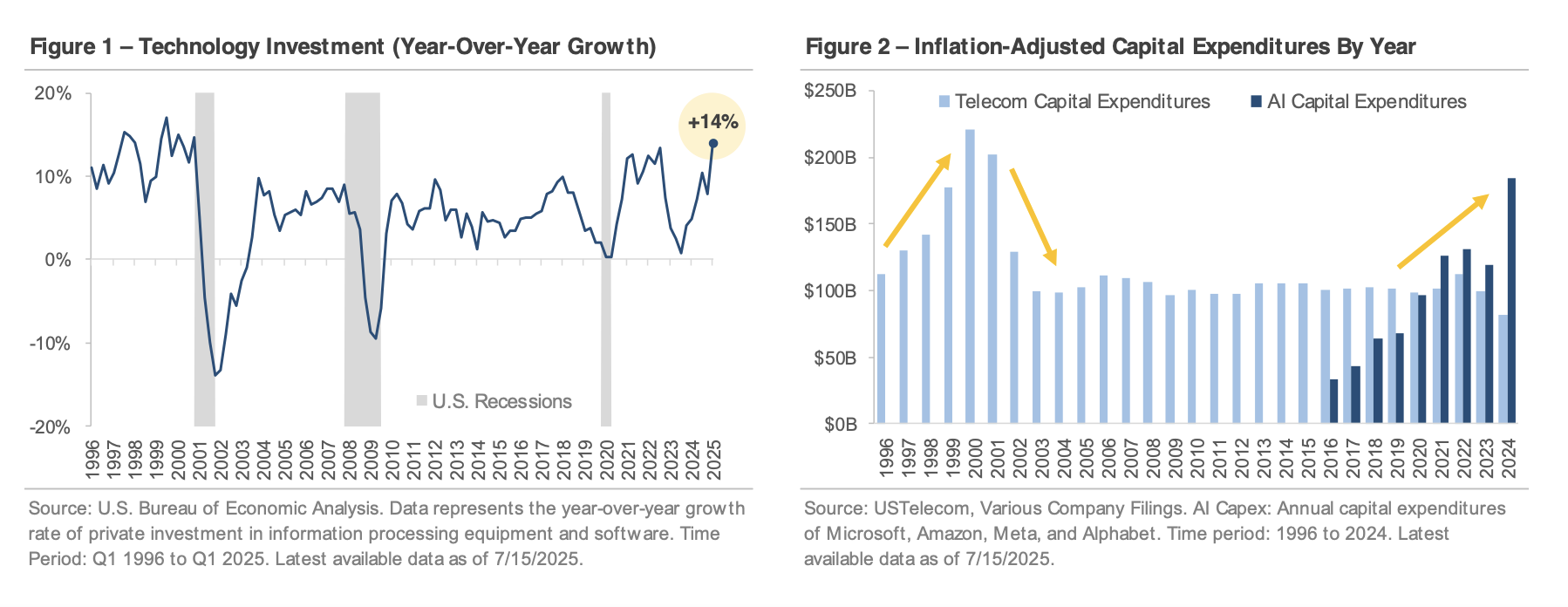

The AI boom is reshaping the economy—and smart law firm owners are paying attention. In our July 2025 market insights, we break down how today’s surge in tech investment mirrors the 1990s internet revolution and what it means for your firm’s long-term financial strategy. Learn how to position your wealth for sustainable growth without getting caught in the hype.

We’re not the right fit for everyone—and we’re not trying to be. If you’re looking for passive portfolio management, a set-it-and-forget-it plan, or someone who avoids the tough conversations, you shouldn’t hire us. But if you’re a law firm owner ready to get serious about building wealth, scaling your firm, and having a true strategic partner in your corner, read on.

Most advisors charge 1% of your assets—but that doesn’t mean you’re getting 1% more value. In fact, traditional AUM fees can cost you thousands while prioritizing the advisor’s paycheck over your goals. This article breaks down why a flat-fee model offers more transparency, better alignment, and a smarter path forward—especially for law firm owners who need business strategy, not just investment advice.

Thinking about checking in with your buddy at a big-name financial firm before deciding? Read this first. We break down how traditional advisors are often compensated through commissions and asset-based fees—and why that can skew the advice you receive. Learn how our flat-fee, business-first approach compares, so you can ask the right questions and make a truly informed choice.

Think our service sounds like a lot of work? You’re not alone—but here’s the truth: it’s not your work. We’ve designed this as a done-for-you, one-stop solution for busy law firm owners. From strategy and tax planning to coordinating with your CPA, we do the heavy lifting behind the scenes. You just show up for key decisions—and we handle the rest. Doesn’t that sound like relief?

Feeling too busy to even think about financial planning or business strategy? You’re not alone—and that’s exactly why you need support now. In this article, we break down why the most successful law firm owners don’t wait for the “perfect time” to get help. Discover how a minimal time investment can deliver clarity, growth, and hours back in your week—starting now.

For growth-minded law firm owners, price isn’t the problem—lack of ROI is. In this article, we break down why our premium pricing reflects the transformational value we deliver: full-service financial planning, business strategy, and a dedicated team built to grow your firm and your personal wealth. If you’re serious about scaling, this investment might be the smartest move you make this year.

Most law firms waste thousands chasing cold leads through digital ads—only to end up hiring intake staff just to sort through the noise. There's a smarter way. In our latest post, we explore how relationship-driven strategies like referral networks, valuable content, and SEO for law firms attract higher-quality clients and create lasting growth.

Tired of chasing down documents, fixing filing errors, and taking every sales call yourself? Discover what the most successful bankruptcy law firms are doing differently. From streamlined intake and automation to tracking the right KPIs and building a real sales team, this guide breaks down how to boost profitability without burning out.

In this month’s market update, we break down why rising profits across the S&P 500 matter for your personal finances, how AI-driven tech stocks are leading the charge, and what smart financial planning looks like in an uncertain policy environment. Whether you're investing for retirement, planning your exit, or just trying to make your money work harder for you, this is the insight you need to stay ahead.

Are you letting the headlines hold your firm back? In this post, we break down the real story behind today’s economy—what soft and hard data are telling us—and why law firm owners should focus on what’s actually happening, not just how people feel. If you're wondering whether now is the right time to grow, hire, or invest in your firm, this is a must-read.

Our founder, Darren Wurz, was recently featured on The Next Lawyer Up podcast with Ron Sykstus! In this episode, Darren shares his journey from teaching to financial planning and why he’s on a mission to help law firm owners achieve financial freedom. Tune in for insights on law firm growth, wealth building, and breaking free from traditional planning models.

Is hiring a financial advisor really worth it? For law firm owners, the answer isn't always obvious — especially when you're used to doing everything yourself. In this article, we explore how working with a financial advisor who truly understands law firm owners can potentially pay for itself through strategic tax planning, smarter investing, business growth strategies, and more.

Already have a CPA, attorney, or financial advisor? Great—we’re not here to replace them. In this post, Darren shares how The Lawyer Millionaire works alongside your existing team to align your business, personal finances, and long-term goals. The best results happen when everyone’s on the same page. Here's how we make that happen.

Earlier this month, the U.S. administration rolled out a sweeping new set of tariffs that could fundamentally shift the global economic landscape. While tariffs might seem like something only Wall Street traders and D.C. policymakers worry about, the truth is this: these changes could ripple into your law firm’s bottom line, your clients’ legal needs, and your long-term financial plan.

Thinking about leaving your firm to start your own solo practice? This post breaks down the financial, strategic, and emotional questions you need to consider before making the leap. From setting up your business structure to building a cash flow runway, Darren walks you through what it really takes to go solo—and succeed.

Deciding whether to hire a financial advisor can raise a lot of questions—especially for law firm owners juggling both personal and business finances. This post explores common considerations, potential benefits, and how to evaluate if working with an advisor aligns with your goals and needs.

Law firm owners face unique financial challenges that go beyond traditional planning. This comprehensive guide explores key areas like business cash flow, tax planning, retirement strategies, and firm structure—offering a framework to help law firm owners better understand and manage both their business and personal finances.